Arabica coffee futures rise on tight supplies

Coffee has been one of the few commodities to stay strong to the coronavirus fallout. The reasons coffee futures strong shows on ICE is due to diminished supplies, transport-related setbacks and unfulfilled demand.

The global coffee industry right now is that supplies remain limited.Top producer Columbia is in the middle of its growing season, while in Brazil the latest crop hasn’t yet been harvested.Thus, high demand for beans has yet to be fully met from these two major producing nations.

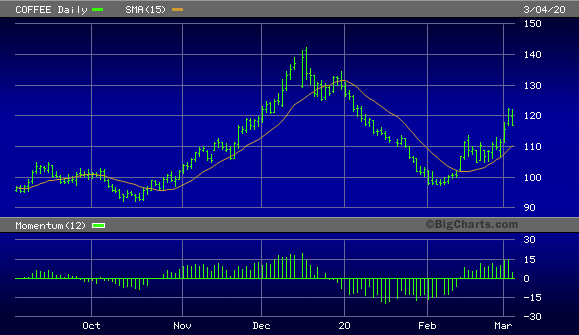

Transportation is also a factor keeping coffee prices buoyant worldwide. The coronavirus pandemic has resulted in numerous delivery headaches and shipping constraints, putting additional pressure on an already tight market. Supply-chain disruptions, nationwide lockdowns and other virus-related setbacks are likely to keep coffee futures prices above the October 2019 lows (see chart below) even as the broad commodity market remains weak.

Cecafe, which represents Brazil’s coffee export sector, has acknowledged that the nation’s green coffee exports for February were down 26% from the year-ago period due to supply shortages. Shipments of widely used Arabica coffee from Brazil were also reportedly down 28%. Less-widely used robusta exports were slightly higher at 3%.

The high demand that exists for coffee right now due to the supply-chain difficulties, a sizable rally could easily ignite once the coronavirus panic has lifted and the dollar returns to normal.

May arabica coffee surged 5.5 cents, or 5.3%, to $1.0800 per lb. It was up 11% earlier at $1.1410, and is on track for its biggest one-day surge since February 2014.

Dealers said there was talk of supply logjams at ports in Brazil and of roasters moving to replenish coffee stocks as retail demand for home consumption surges.

ICE certified stocks KC-TOT-TOT plunged by 14,733 60-kg bags on Tuesday alone. They now total 2.08 million bags, their lowest since mid-January.

Soaring arabica premiums in the physical markets are deterring traders from delivering coffee to the exchange where it commands little, if any, mark-up.

ICE Futures U.S. cannot ensure that the sampling of cocoa and arabica coffee can be completed in time for May 2020 contracts due to “developing conditions related to the coronavirus”.

May robusta coffee rose $9 or 0.7% to $1,221 a tonne.