Tea to Coffee – China’s growing coffee production

China- The land of tea, in recent years, both the production and consumption of coffee in China have been growing at double-digit rates.It is estimated that China now produces more coffee than Kenya and Tanzania combined, and consumes more than Australia.

History

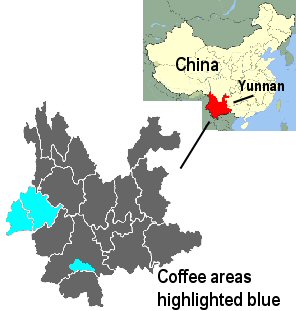

Coffee was first introduced to China in the late nineteenth century by a French missionary in Yunnan province, in the southwest of the country. Coffee production subsequently languished for the better part of a century, until 1988 when the Chinese Government, in association with the World Bank and the United Nations Development Programme, initiated a project to regenerate the sector. Large companies like Nestlé also encouraged coffee growing in the region, and as a result production soared.

Coffee was first introduced to China in the late nineteenth century by a French missionary in Yunnan province, in the southwest of the country. Coffee production subsequently languished for the better part of a century, until 1988 when the Chinese Government, in association with the World Bank and the United Nations Development Programme, initiated a project to regenerate the sector. Large companies like Nestlé also encouraged coffee growing in the region, and as a result production soared.

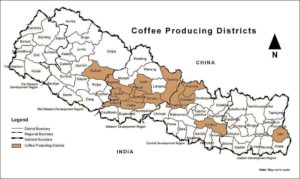

Coffee is still predominantly grown in Yunnan province, which accounts for over 95% of China’s coffee output. Yunnan is traditionally a tea-growing region, source of the renowned ‘Pu’er’ tea. However, with its mountainous landscape (an average altitude of around 2,000 metres) and mild climate it is well-suited to coffee production. It also borders Vietnam, Laos and Myanmar, in the heart of the coffee belt. It grows exclusively Arabica coffee, and is a large province with an area of 394,000 km and population of 46 million people. There are also small amounts of Robusta grown on the island of Hainan, situated in south China, and in Fujian province, in the southeast.

Coffee production in China has escalated rapidly over the last twenty years. Figures from the Food and Agriculture Organization (FAO) suggest that output in crop year 2013/14 reached 1.9 million bags, and has been roughly doubling every five years.

This would make China the 14th largest producer of coffee in the world, ahead of Costa Rica but behind Nicaragua, compared to the 30th worldwide ten years ago with a level of 361,000 bags.

Private sector interest in China’s coffee production

This growth in production has been encouraged by significant investment in the sector, from both the public and private sector.

Private sector involvement in China’s coffee production has also been growing recently.

Private sector involvement in China’s coffee production has also been growing recently.

Nestlé has been present in Yunnan province since the late 1980s, but has significantly increased its purchasing and investment in the last few years. In 2013, Nestlé signed a memorandum of understanding with the local government of Pu’er to invest in a regional coffee centre. Starbucks has also been looking to expand its presence in the area,opening a farmer support centre in 2012 piloting the adaptation of alternative varietals with an emphasis on improving quality. Furthermore, in October 2014, the coffee trader Volcafe announced plans to partner with a local company, Simao Arabicasm Coffee Company, to source, process and export Chinese coffee beans to the international market.

Yunnan Speciality Arabica Coffee

Arabica production in Yunnan province has been growing substantially, and the Coffee Association of Yunnan has set a target of 4 million bags by 2020. Furthermore, looking at the import/export statistics for China suggests that an increasing proportion of local production is being consumed internally. This trend fits the narrative that companies involved in both supply and demand in China, such as Nestlé and Starbucks, are increasingly investing in Chinese coffee production in order to supply the local market with specifically targeted blends and products. As the preference for Arabica in China continues to rise, this pattern looks likely to continue.

Arabica production in Yunnan province has been growing substantially, and the Coffee Association of Yunnan has set a target of 4 million bags by 2020. Furthermore, looking at the import/export statistics for China suggests that an increasing proportion of local production is being consumed internally. This trend fits the narrative that companies involved in both supply and demand in China, such as Nestlé and Starbucks, are increasingly investing in Chinese coffee production in order to supply the local market with specifically targeted blends and products. As the preference for Arabica in China continues to rise, this pattern looks likely to continue.

Coffee production in Yunnan region has also been promoted by the decline in tea prices, making coffee significantly more remunerative. Farmers in the area can reportedly make double the income compared to tea over the same land area; farmers are also converting from maize or rice production because of the higher expected return.

Quality

There is some debate over the current quality of China’s production. It is generally considered to fall short of speciality coffee standards, yet is too high to be used purely for local consumption. Most of the Arabica production is fully washed Catimor, although producers have recently been moving towards other varietals including Typica and Bourbon, which can bring a higher return.